Trade Review and Advice on Trading the British Pound

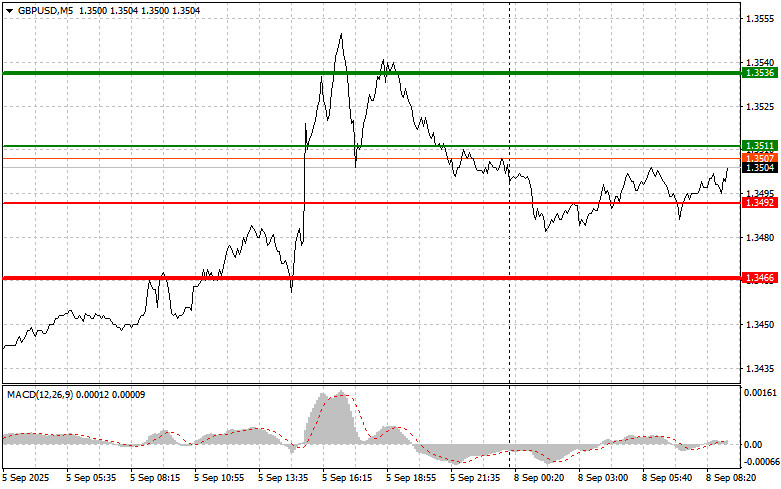

The price test at 1.3493 occurred at a time when the MACD indicator was starting to move upward from the zero mark, which confirmed the correct entry point for buying the pound and resulted in growth toward the target level of 1.3546. Selling from there on the rebound allowed for an additional profit of about 30 pips from the market.

The latest report from the U.S. Department of Labor showed that employment in the U.S. rose by only 22,000 in August, which led to a sharp drop in the dollar and strengthening of the pound. This figure falls significantly short of forecasts, which anticipated over 75,000 new jobs, and raises serious concerns about the pace of growth in the American economy. The reaction of the currency markets was immediate and clear. Weak employment data may force the Federal Reserve to reconsider its plans to cut interest rates, which increases the likelihood of a looser policy by year-end.

Unfortunately, there is no economic data from the UK today. The absence of key economic indicators, including inflation numbers, employment rates, and GDP, leaves traders without informational benchmarks to form a clear view of the British economy's state. In the absence of news, the dynamics of the pound sterling will largely depend on global factors such as changes in overall risk sentiment in markets and movements of the US dollar. Investors will be forced to rely on indirect data, including European and American data, to draw conclusions about the potential impact of these events on the UK economy. In this situation, the role of technical factors and market sentiment increases, which can lead to sharper and more unpredictable GBP/USD fluctuations.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3511 (green line on the chart) with a target of rising to 1.3536 (thicker green line on the chart). Around 1.3536, I plan to exit the buys and open sells in the opposite direction (aiming for a movement of 30-35 pips in the opposite direction from the level). Counting on the pound's rise today is possible within the framework of the Friday trend. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting its move up from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the price at 1.3492 at a time when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward reversal of the market. Growth can be expected towards the opposite levels of 1.3511 and 1.3536.

Sell Scenario

Scenario No. 1: I plan to sell the pound today after the level of 1.3492 (red line on the chart) is updated, which will lead to a rapid decline in the pair. The key target for sellers will be the level of 1.3466, where I plan to exit the sells and immediately open buys in the opposite direction (aiming for a movement of 20-25 pips in the opposite direction from the level). Pound sellers may show themselves at any moment today. Important! Before selling, make sure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the price at 1.3511 at a time when the MACD indicator is in the overbought area. This will limit the upside potential of the pair and lead to a reversal of the market downwards. A decline can be expected to the opposite levels of 1.3492 and 1.3466.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.