Markets climb ahead of crucial inflation report

On Tuesday, the MSCI global equity index edged higher, the US dollar strengthened, and Treasury yields moved upward as investors awaited key inflation figures. The cautious optimism followed a significant revision of US employment statistics.

Labor market growth revised downward

The US Department of Labor announced that for the 12 months ending in March, the economy generated 911 thousand fewer jobs than previously estimated. Analysts note that the slowdown in hiring began even before President Donald Trump introduced aggressive import tariffs.

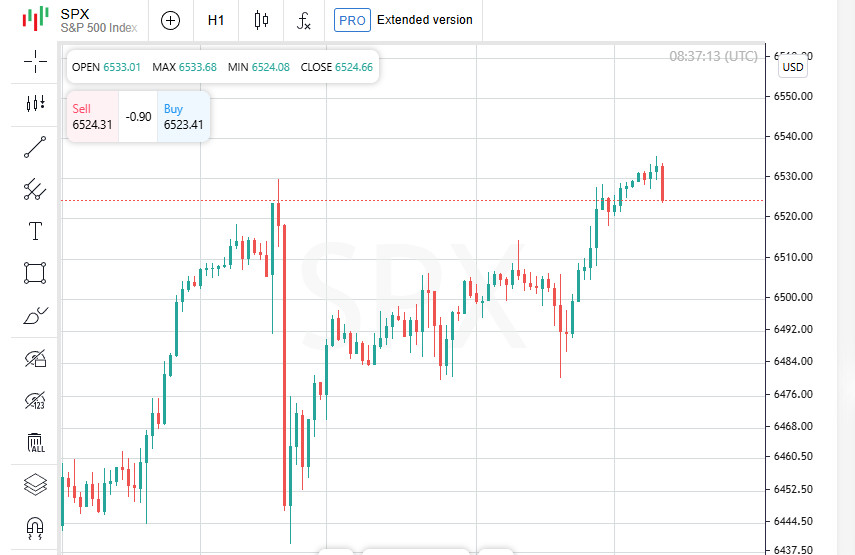

Wall Street sets new highs

All three major Wall Street benchmarks closed in positive territory. The S&P 500 added 17.46 points, or 0.27%, reaching a record close at 6512.61. The Dow Jones Industrial Average climbed 196.39 points, or 0.43%, finishing at 45,711.34. The Nasdaq Composite hit another all-time high for the second consecutive day, rising 80.79 points, or 0.37%, to 21,879.49.

Global equities show resilience

The MSCI all-country index advanced 2.22 points, or 0.23%, to 961.10. Europe's STOXX 600 inched up 0.06%, while emerging market stocks surged 12.06 points, or 0.94%, closing at 1294.26.

Macron appoints new prime minister

French President Emmanuel Macron has named Sebastien Lecornu as the country's new prime minister, marking the fifth change of head of government in less than two years. The reshuffle came after opposition parties joined forces to oust centrist Francois Bayrou, whose unpopular austerity plans triggered widespread backlash.

Political shifts across the globe

Markets also reacted to a series of developments abroad. In Japan, the prime minister stepped down; in Argentina, President Javier Milei's party suffered a defeat in local elections; and Indonesia abruptly replaced its finance minister.

Argentina's market under pressure

After plunging more than 13 percent on Monday, Argentina's Merval index slipped another 0.3 percent on Tuesday, extending its losses.

Wall Street movers

Shares of UnitedHealth advanced after the insurer said it expects enrollment in top-rated Medicare programs to remain in line with projections, signaling potential increases in government reimbursements.

JPMorgan Chase rose 1.7 percent as a senior executive forecasted that investment banking revenue would climb by several dozen percent in the third quarter, with trading revenue also posting significant gains.

Tech sector retreats

Apple dropped 1.5 percent after unveiling its new iPhones, which failed to excite investors. Broadcom declined 2.6 percent following five straight sessions of gains that had boosted the market value of the world's second-largest chipmaker.

Inflation data takes center stage

Markets are bracing for a critical week of economic releases. Producer price inflation will be reported on Wednesday, followed by consumer price figures on Thursday. Together, these numbers will shed light on the impact of Donald Trump's tariff policies and the likelihood of a more aggressive path of interest rate cuts by the Federal Reserve.

Nebius surges on Microsoft deal

Shares of Nebius soared nearly 50 percent after the artificial intelligence infrastructure company announced a 17.4 billion dollar agreement with Microsoft. Rival CoreWeave also benefited, gaining 7 percent.

Murdoch family reshapes media empire

Fox Corp Class B stock tumbled 6.7 percent, while News Corp slipped 4.5 percent. The moves came after Rupert Murdoch and his children finalized an arrangement handing control of the media conglomerate to his eldest son, Lachlan Murdoch.

Lithium giant under pressure

Albemarle shares sank 11.5 percent as investors anticipated the restart of lithium mining operations by China's CATL. The expected recovery in supply eased fears of shortages and dragged down the US producer's stock.

Oracle shines after earnings

In after-hours trading, Oracle jumped 12 percent following the release of its quarterly report, delivering a strong boost to investor confidence in the tech sector.

Asian markets echo Wall Street gains

Asian equities climbed on Wednesday, taking their cue from Wall Street's rally. At the same time, safe-haven bonds lost ground as traders grew more confident that signs of weakness in the US labor market will push the Federal Reserve to cut interest rates by at least a quarter point next week.

Regional indexes on the rise

Japan's Nikkei advanced 0.8 percent, while South Korea's KOSPI surged 1.7 percent. Taiwan's benchmark added 1.5 percent, hitting a fresh all-time high.

Gains in China and Hong Kong

The Hang Seng index in Hong Kong rose 1.3 percent, and mainland China's CSI300 edged up 0.3 percent.

Japanese bond yields edge higher

The yield on Japanese government bonds moved up by 0.5 basis points to 1.565 percent. The increase came after a smooth five-year bond auction briefly interrupted the prior upward momentum.

Dollar index eases lower

The US dollar index, which tracks the currency against six major peers, slipped slightly to 97.707 on Thursday, erasing its modest recent gains.

Currency moves

The dollar traded nearly unchanged at 1.1715 against the euro, while weakening 0.07 percent to 147.31 versus the Japanese yen.

Bank of Japan meeting ahead

Looking ahead, the Bank of Japan is set to announce its latest monetary policy decision next Friday. Market watchers widely expect the central bank to hold off on raising rates this time.

Gold extends gains

Gold prices rose 0.5 percent to 3644 dollars per ounce, after briefly hitting an unprecedented 3673.95 dollars a day earlier.

Oil futures advance

Brent crude futures climbed 1.1 percent to 67.13 dollars a barrel, while US benchmark West Texas Intermediate also gained 1.1 percent, reaching 63.34 dollars.