Trade Review and Tips for Trading the Euro

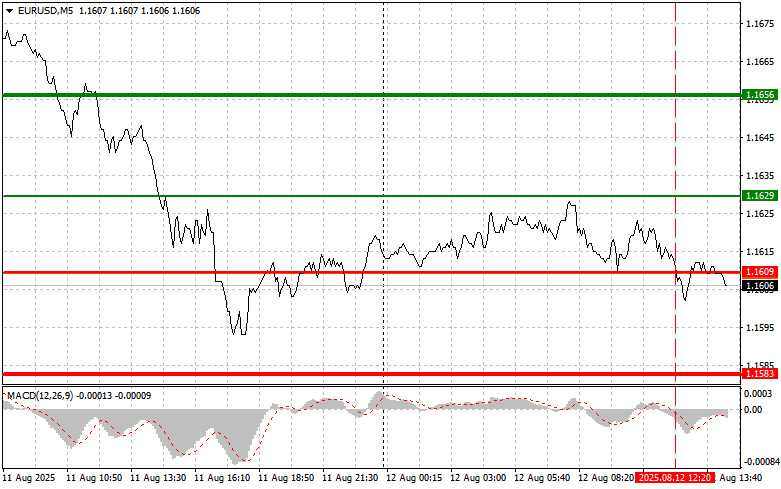

The price test at 1.1609 coincided with a significant decline of the MACD indicator below the zero level, which limited the pair's downward potential. For this reason, I did not sell the euro.

In the first half of the day, data was released that put pressure on the euro. Extremely disappointing figures for sentiment and business climate indexes in Germany and the eurozone are likely to affect investors' expectations regarding further weakening by the European regulator. The decline in IFO indexes, reflecting German business sentiment, is evidence of an economic slowdown. Forecasts are becoming increasingly pessimistic, while assessments of the current situation leave much to be desired.

In the second half of the day, investors and traders will focus on US Consumer Price Index data for July. Core inflation figures will also be important. These indicators are key barometers of inflationary pressure and, therefore, can have a significant impact on the Federal Reserve's future interest rate strategy. If CPI exceeds forecast values, concerns about persistent inflation will intensify and may push the Fed toward a more hawkish stance. In such a scenario, the US dollar is likely to strengthen further, putting additional pressure on the euro. Conversely, weaker-than-expected CPI data could quickly shift the pressure back onto the dollar.

At the same time, markets will closely monitor remarks from Federal Open Market Committee member Thomas Barkin. His assessment of the current economic situation and monetary policy outlook could provide important clues about the Fed's next moves. Investors will carefully analyze his statements to gauge the likelihood of the first rate cut this year.

As for the intraday strategy, I will focus more on implementing scenarios No. 1 and No. 2.

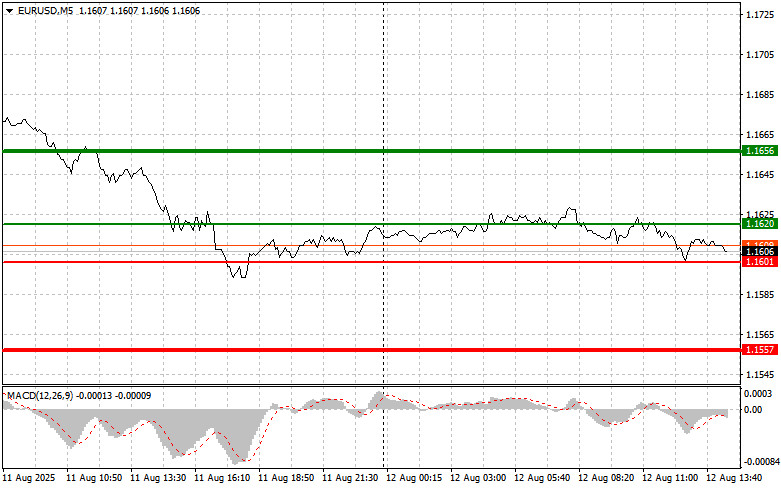

Buy Signal

Scenario No. 1: Today, buying the euro is possible when the price reaches the area of 1.1620 (green line on the chart) with the target at 1.1656. At 1.1656, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35-point move from the entry point. A strong euro rally today will be possible if US inflation shows a decline. Important! Before buying, make sure that the MACD indicator is above the zero level and just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1601 price level, at a time when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1620 and 1.1656 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches 1.1601 (red line on the chart). The target will be 1.1557, where I plan to exit the market and immediately buy in the opposite direction (aiming for a 20–25-point move from the level). Downward pressure on the pair could persist into the second half of the day. Important! Before selling, make sure that the MACD indicator is below the zero level and just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today if the price tests 1.1620 twice in a row, at a time when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a reversal downward. A drop toward the opposite levels of 1.1601 and 1.1557 can be expected.

What's on the chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – projected price for setting Take Profit or manually locking in profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – projected price for setting Take Profit or manually locking in profit, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to use overbought and oversold zones as a guide.

Important: Beginner Forex traders should be very cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember, for successful trading, you need a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.