Trade Review and Advice on Trading the British Pound

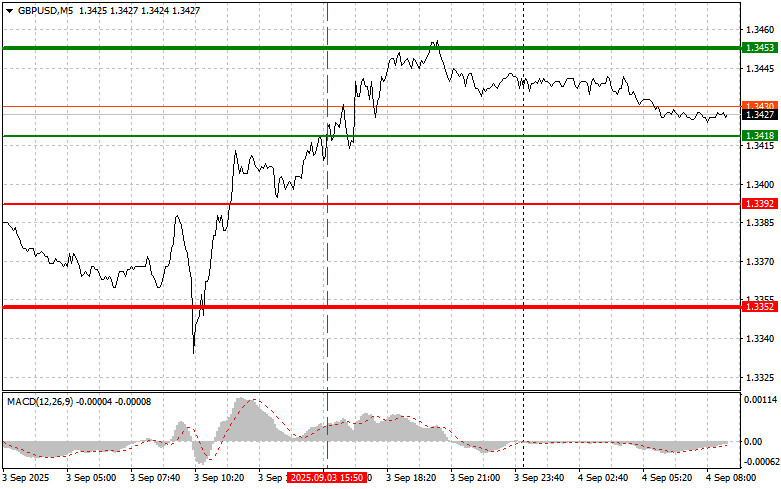

The test of the 1.3418 price level happened when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound and missed the upward move.

The disappointing data on job openings and increased labor turnover, published by the US Bureau of Labor Statistics yesterday afternoon, put significant pressure on the dollar's position, allowing the British pound to further strengthen its position in the currency market. Many market participants associate the dollar's decline following the data with expectations of a more dovish monetary policy from the US Federal Reserve in response to deteriorating economic indicators. A reduction in interest rates will most likely lower the dollar's appeal for international investors, logically leading to further weakening of the US currency.

Today, in the first half of the day, PMI data for the UK construction sector is expected. This indicator, reflecting the mood among purchasing managers in construction companies, serves as a leading indicator of the state of the British economy. A reading above 50 indicates growth in the sector, while a reading below 50 points to contraction. Previous months displayed mixed dynamics, creating a certain level of uncertainty about today's release. If the index exceeds expectations, this could support the pound sterling, reflecting confidence in the resilience of the construction industry and broader economic prospects. On the other hand, a reading below the forecast may trigger pound sell-offs, as it will be seen as a signal of a slowdown in growth.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

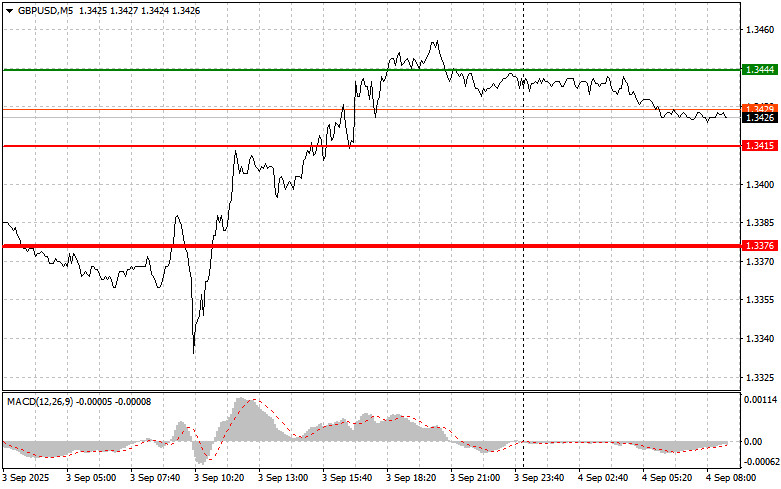

Scenario #1: Today, I plan to buy the pound when the entry point near 1.3444 (green line on the chart) is reached, with a target to rise to 1.3477 (thicker green line on the chart). Around 1.3477, I plan to exit the longs and open short positions in the opposite direction (expecting a move of 30–35 points back from the level). Counting on pound growth today is only reasonable after very strong data. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2: Today, I also plan to buy the pound in the event of two consecutive tests of the 1.3415 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. You can then expect growth to the opposite levels of 1.3444 and 1.3477.

Sell Scenario

Scenario #1: Today, I plan to sell the pound after the 1.3415 level is renewed (red line on the chart), which will likely lead to a sharp drop in the pair. The key target for sellers will be the 1.3376 level, where I plan to exit shorts and immediately open long positions in the opposite direction (expecting a move of 20–25 points back from the level). Pound sellers could step in at any moment, especially after weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: Today, I also plan to sell the pound in the event of two consecutive tests of the 1.3444 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. You can then expect a decline to the opposite levels of 1.3415 and 1.3376.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.