The Euro and the Pound Spiked Sharply Amid New Rumors Circulated by U.S. President Donald Trump — Followed by a Sudden Drop After Denials

Yesterday's news that U.S. President Donald Trump had floated the idea of removing Federal Reserve Chairman Jerome Powell from his post during a closed-door meeting with Republicans in Congress led to a sharp drop in the dollar and a rally in risk assets. Investors interpreted this as another wave of political instability and a potential threat to the independence of the country's monetary policy. The U.S. Dollar Index (DXY), which tracks the greenback's performance against a basket of six major currencies, dropped by 0.7% within an hour of the news release.

The event caused concern among economists and financial analysts. Many emphasized that central bank independence is a cornerstone of a stable economy, and any interference with its operations could undermine investor confidence and lead to unpredictable consequences. However, after Trump denied the rumors, markets quickly returned to previous levels.

Eurozone Inflation Data in Focus

Today, during the first half of the day, market participants await the release of the Eurozone Consumer Price Index (CPI) and Core CPI figures for June. These numbers have a tangible impact on investor sentiment and the stance of the European Central Bank (ECB). Increased inflationary pressure, as reflected in the CPI, could prompt the ECB to reconsider its current monetary policy — specifically, to slow the pace of interest rate cuts. This outlook would potentially make the euro more attractive to traders seeking higher yields, thereby strengthening its position in global markets.

At the same time, alternative scenarios should be considered. If the data indicate a decline in inflation or stabilization at the current level, the ECB is likely to maintain its current policy stance. This could disappoint market participants and lead to a weakening of the euro.

Key UK Labor Market Data Ahead

Today is also packed with important data from the UK. The economic calendar begins with reports on jobless claims and the unemployment rate, and ends with data on average wage growth. These indicators are crucial for analyzing the current state of the UK labor market and its broader economic implications.

An increase in jobless claims would signal a deterioration in employment conditions, potentially foreshadowing a slowdown in economic growth. Meanwhile, the unemployment rate offers a more comprehensive view of the labor market situation.

If the data matches economists' expectations, the best approach is to follow a Mean Reversion strategy. If the data significantly deviates from expectations — either much higher or lower — the Momentum (breakout) strategy would be more effective.

Momentum Strategy (Breakout):

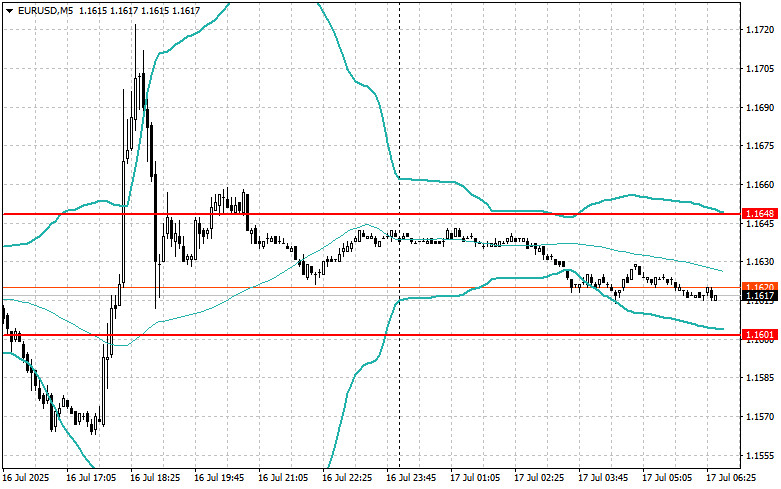

EUR/USD

Buying on a breakout above 1.1625 may lead to a rise in the euro towards 1.1660 and 1.1691

Selling on a breakout below 1.1609 may lead to a decline in the euro towards 1.1565 and 1.1511

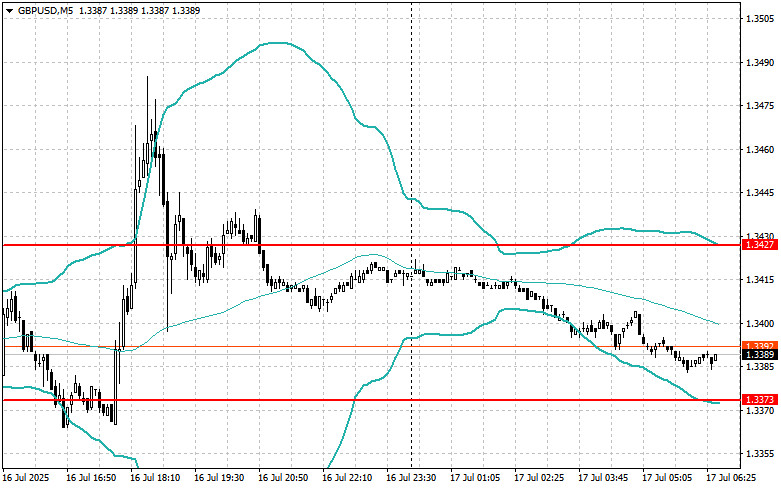

GBP/USD

Buying on a breakout above 1.3415 may lead to a rise in the pound towards 1.3462 and 1.3500

Selling on a breakout below 1.3370 may lead to a decline in the pound towards 1.3335 and 1.3290

USD/JPY

Buying on a breakout above 148.60 may lead to a rise in the dollar towards 149.00 and 149.30

Selling on a breakout below 148.40 may lead to a drop in the dollar towards 148.10 and 147.85

Mean Reversion Strategy (Pullbacks):

EUR/USD

I will look for sell opportunities after a failed breakout above 1.1648 and a return below this level

I will look for buy opportunities after a failed breakout below 1.1601 and a return to this level

GBP/USD

I will look for sell opportunities after a failed breakout above 1.3427 and a return below this level

I will look for buy opportunities after a failed breakout below 1.3373 and a return to this level

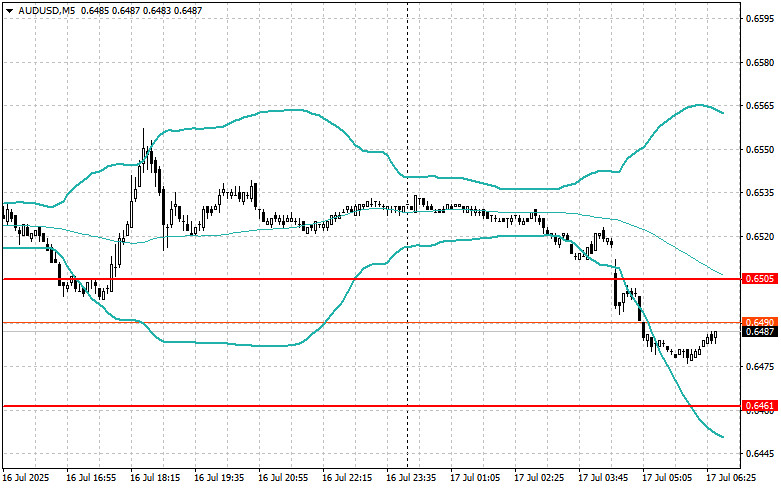

AUD/USD

I will look for sell opportunities after a failed breakout above 0.6505 and a return below this level

I will look for buy opportunities after a failed breakout below 0.6461 and a return to this level

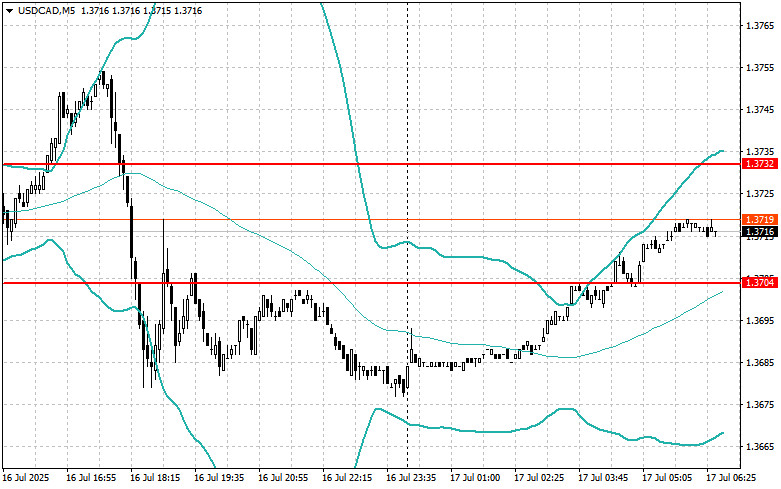

USD/CAD

I will look for sell opportunities after a failed breakout above 1.3732 and a return below this level

I will look for buy opportunities after a failed breakout below 1.3704 and a return to this level