Trade Review and Advice on Trading the Euro

The test of the 1.1660 price level occurred at a time when the MACD indicator was just starting to move up from the zero mark, which confirmed the correctness of the entry point for buying the euro. As a result, the pair rose by 20 points.

The release of disappointing data on job openings and labor turnover from the US Department of Labor had a negative impact on the dollar's position, which contributed to further strengthening of the euro against it. Market participants who closely analyze macroeconomic indicators regarded the provided information as a harbinger of a potential slowdown in US economic growth. The published figures indicated a decrease in the number of unfilled jobs, which is a possible sign of weakening demand for labor. At the same time, there was an increase in the number of layoffs, which usually reflects employees' concerns about their current position and their desire to find better employment opportunities. Together, these aspects create the prerequisites for a weakening American labor market.

Today, the primary focus will be on the publication of data on changes in retail sales in the Eurozone for July. A reduction in retail sales is often seen as a harbinger of a slowdown in economic growth since consumer spending is an important stimulus for the economy. In the Eurozone, where several countries continue to face economic challenges, a further decline in consumer activity could complicate the situation and put additional pressure on the ECB to implement further support measures.

However, the probable impact of this data on the euro exchange rate will be indirect. Since the expected decline in retail sales is already priced into the market, unexpected deviations—either way—can cause more noticeable fluctuations. If the actual numbers turn out to be worse than forecast, the euro may come under additional pressure. Conversely, if the decline is not as severe, the euro may temporarily strengthen.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

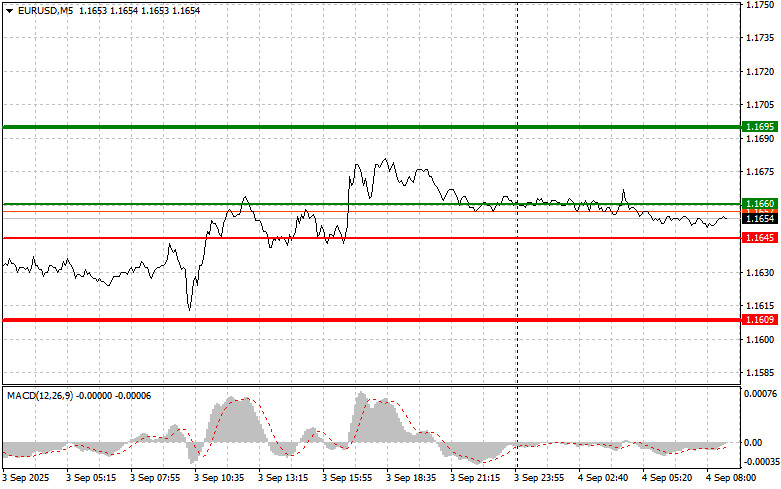

Scenario #1: Today, you can buy the euro when the price reaches the area of 1.1660 (green line on the chart) with a target of rising to 1.1695. At 1.1695, I plan to exit the market and also sell the euro in the opposite direction, counting on a move of 30–35 points from the entry point. You can count on euro growth only after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: Today, I also plan to buy the euro in case of two consecutive tests of the 1.1645 price when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. You can expect a rise to the opposite levels of 1.1660 and 1.1695.

Sell Scenario

Scenario #1: I plan to sell the euro after reaching the 1.1645 level (red line on the chart). The target will be 1.1609, where I intend to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 points in the opposite direction from this level). Pressure on the pair will return today if the data is weak. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to fall from it.

Scenario #2: Today, I also plan to sell the euro in case of two consecutive tests of the 1.1660 price when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. You can expect a fall to the opposite levels of 1.1645 and 1.1609.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.