The EUR/USD currency pair continued its downward movement throughout Friday, which began Wednesday evening. After these 2.5 days, it's difficult to say the euro depreciated significantly or that the dollar strengthened dramatically. Nonetheless, the price has consolidated below the moving average line, which at the very least prevents us from considering long positions in the near term as the most logical approach.

Despite the pair's decline in the final days of last week, our expectations remain entirely unchanged. We still see no fundamental reason for the dollar to grow in the medium term. It's just that the upward movement is no longer as strong as it was in the first six months of this year. The dollar continues to lose value, but we're talking about the forex market—one of the largest in the world. The U.S. currency, which still retains its "safe haven" status, simply cannot fall every day or every week. However, the global fundamental background continues to point firmly toward the weakening of the U.S. dollar.

What changed last week? In our view—nothing. The most important event, the Federal Reserve meeting, merely confirmed traders' dovish expectations. The Fed is now positioned to carry out two more rate cuts by the end of the year, exceeding its own early-year forecasts. And as for what will happen in 2026 or even in the next few months under Donald Trump—no one knows.

It should be noted that the labor market could continue contracting, since a single rate cut is unlikely to save it. Inflation may continue to rise, as none of the U.S. courts have struck down Trump's import tariffs. Trump himself may implement new tariffs against India and China, and he's demanding similar measures from the European Union. At the same time, in early November, a large portion of these tariffs could be declared illegal by the Supreme Court—the final authority in the matter. As a result, even in the next few months, macroeconomic data and global developments could drastically influence the Fed's monetary policy.

And this is not to mention Trump's own actions, aimed—most agree—at "reformatting" the FOMC's composition. This is a lengthy process, but it could eventually yield results. When the market senses that the Fed is losing its independence and rates are poised to fall rapidly, the dollar could plummet once again.

It's also worth noting that on the weekly timeframe, the pair rebounded from a global downward trendline, and on the 4-hour chart, the CCI indicator had entered the overbought territory. The euro also suffered a "bearish" blow from the British pound, which, due to its own issues, sharply declined at the end of the week and dragged the euro down with it. However, we believe this is merely another technical correction.

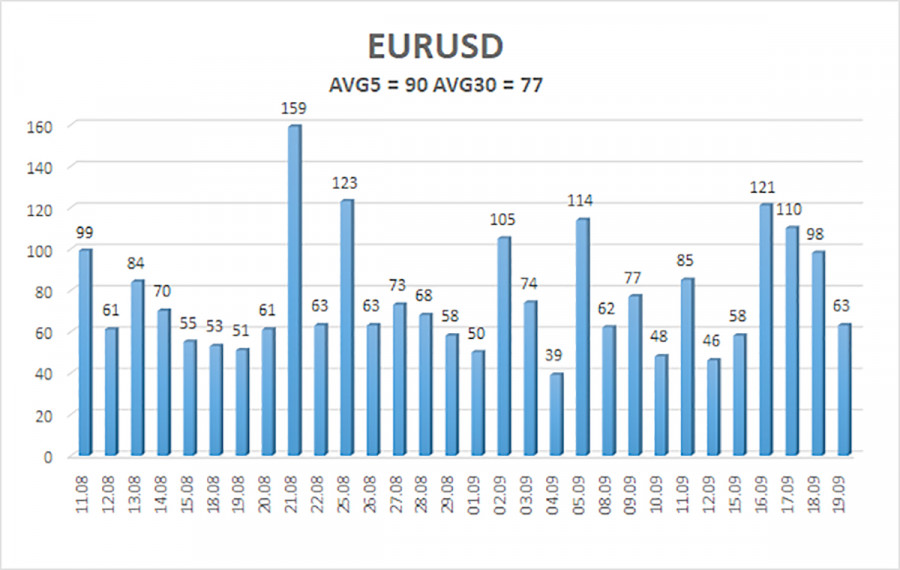

Average volatility for the EUR/USD pair over the last 5 trading days, as of September 22, is 90 points, which is considered "average." On Monday, we expect movement between the levels of 1.1656 and 1.1836. The senior linear regression channel is still aimed upward, indicating a continuing uptrend. The CCI indicator entered overbought territory last week, which may have triggered this new wave of downward correction.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1597

- S3 – 1.1475

Nearest Resistance Levels:

Trade Recommendations:

The EUR/USD pair has started a new wave of corrective movement; however, the uptrend remains intact, which is evident across all timeframes. The U.S. currency remains under strong pressure from Donald Trump's policies, and he shows no signs of "backing down." The dollar has risen for as long as it could (a full month), but now it seems we are entering a new phase of prolonged decline. When the price is below the moving average, short positions may be considered with targets at 1.1719 and 1.1656 on purely technical grounds. Above the moving average line, long positions remain relevant with targets at 1.1841 and 1.1963 in continuation of the trend.

Explanation of the chart elements:

- Linear regression channels help identify the current trend. If both channels are aimed in the same direction, the trend is considered strong.

- The moving average line (settings: 20.0, smoothed) defines the short-term trend and the direction in which to trade.

- Murray levels – target levels for movements and corrections.

- Volatility levels (red lines) – the likely price channel where the pair may trade over the next 24 hours, based on current volatility metrics.

- The CCI Indicator – when it enters oversold territory (below -250) or overbought territory (above +250), it signals a potential trend reversal in the opposite direction.