This entry was posted on Wednesday, June 13th, 2012 at 9:03 am and is filed under Important Announcements. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

13.06.2012 Post in Important Announcements

Traders guided by the technical analysis are familiar with classical patterns. Anyway it is also useful to learn about quite rare reversal pattern called “Diamond Pattern”.

The pattern is formed between two spikes making it possible to get profit from the second one. The spike magnitude sometimes yields enough for buying a small diamond.

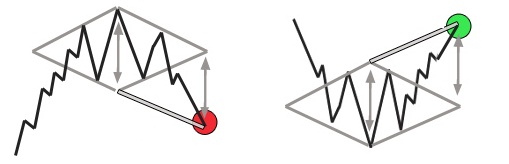

Support and resistance lines, which form a rhombus, help to find the diamond. The rhombus itself can be split into two triangles with a common base. Within the first one the price range formula reaches its maximum; in contrast, within the second one it goes down to a certain minimum. There are two types of diamond patterns: diamond top formed on an ascending trend and diamond bottom formed in the lower point of a descending trend.

Afterwards, there is a support breakdown followed by the upturn or resistance breakdown followed by the downfall. Fluctuations may exceed the rhombus bounds, but after a short period of time, relatively to the period of a diamond formation, there will be a spike and a trend change. It is better to enter the market when the pattern is already formed (the price on the chart is making either uptick or downtick breakdown).

The spike magnitude will be not less than the distance of the maximum amplitude in the rhombus (which is the length of the triangles’ common base). If we measure out this length from the breakdown point in the right direction, we will get a probable target and a point for a take profit order.

It takes more time for the diamond to form before the uptick than before the downtick. It is the result of different traders’ behavior during the ascending and descending trends. Within the short timeframes (less than one day) the diamond pattern may not work properly, to be more precise, may not indicate the future direction of the market development. That is why it is better to use this pattern within the large timeframes.

Added by Andrey Misyuk,

InstaForex Clients’ relationship manager